As an early stage venture fund, we focus on a few sectors to be effective: eCommerce, SaaS, marketplaces, and ad tech. For each, we evaluate the people and process, but there are a few things we focus on. Starting with eCommerce, I’ll break down our approach intro two blog posts: for now, the quality; then, the quantity.

The Quality:

As a company grows, operations become more important as eCommerce businesses need to run incredibly efficiently in order to retain any of their contribution margins since they’re high variable cost businesses. So, we use these rules of thumb to evaluate those variables.

In operations:

1. Businesses that transcend fads

We look to invest in companies that are here to stay. I think of them as utility companies because they are things people would be purchasing anyways. This way, you don’t have to convince consumers to buy something, you just have to convince them to buy it from you.

Ex. We wouldn’t invest in a company that sells bell-bottoms online, but coffee? Yes.

2. Life cycle of company

eCommerce brands typically have seven or eight-year life cycles before they go out of fashion. We look for companies that have found (or will find) product market fit within two years, can scale growth for two or three years after that, and then continue in maturity for the rest of their lifecycle.

3. Capital efficient business models

We look for companies that are innovative in figuring out low cost ways to mitigate overhead and maintain efficiency. That includes inventory. What are warehousing costs and what’s your payment cycle like? Maybe you don’t have to warehouse tangible items but you need to pay your supplier 10 days in advanced of sales. This is important to know for net working capital needs.

Ex. In its first year, Zappos bought inventory from its suppliers only after they transacted a sale, therefore not having to hold inventory or rent excess storage space.

4. End-to-end fulfillment and manufacturing process

Supply chain and shipping can make or break an eCommerce company. While getting favorable shipping rates is hard at first for low volume startups, we want to see you have a plan for reducing costs and increasing margin in the future.

5. Marketing strategy

eCommerce companies are typically business to consumer (B2C), and therefore need an audience. What strategies do you plan on using to get eyeballs to your website? Some successful examples we’ve seen are partnerships with complementary brands, paid social/search marketing, referral discounts, and tracked email marketing campaigns.

In people:

1. Passion and reason

We look for founders who are passionate about what they’re building and have a good reason to do so.

2. Seasoned founders

eCommerce is a hard sector to be successful in. Questions we ask ourselves are: have they done it before? Was it in the same vertical? If not, do they have industry expertise in this vertical? If they were previously unsuccessful, how is this different than last time around? What’d they learn?

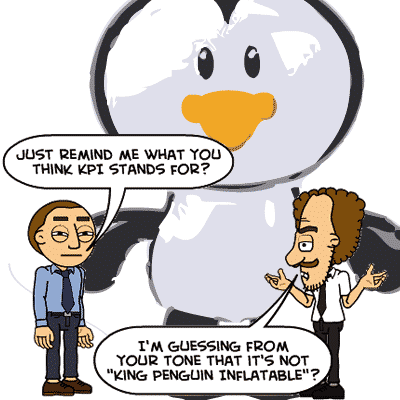

3. Key performance indicators

We want to make sure entrepreneurs understand what will tank their business vs. what will propel its growth. Do they know the levers that control these indicators?

4. Presentation and understanding of metrics

Be honest about the successes and the struggles you’re facing. Pay attention to the notion of vanity metrics vs. actionable metrics. For instance, short-term revenue or user spikes don’t matter if they’re just paid for and unsustainable. Usually, sophisticated investors will be able to see through this. We look for virality and engagement of users more than just existence of users. Your best asset is a loyal and a highly engaged customer base.

That’s it for now, subscribe in the footer and look out for Part 2 on the quantifiable metrics we look to track.